What is Essential? Part 2

In May 2020, near the start of the COVID19 global pandemic, I wrote a post called “What is Essential?” It was a reflection on what goods and services the government leading the province in which live considered to be essential. Supermarkets and access to food were essential. No surprise there. So were beer and liquor stores. Schools were closed. Did that mean access to education was not essential? There were a few other salacious businesses that re-opened quite early in pandemic times and were considered essential.

It’s January 2021 and where I live, we’re in another phase of serious COVID19-instigated business closures and stay-at-home protocols, but it’s even more confusing this time. Whether or not an activity or service is essential has been left open to interpretation. By not being clear, the risk has been shifted to individuals and business owners to make their case as to whether their business activity or service is essential.

A couple of interesting impacts arise from this.

Essential is on a spectrum

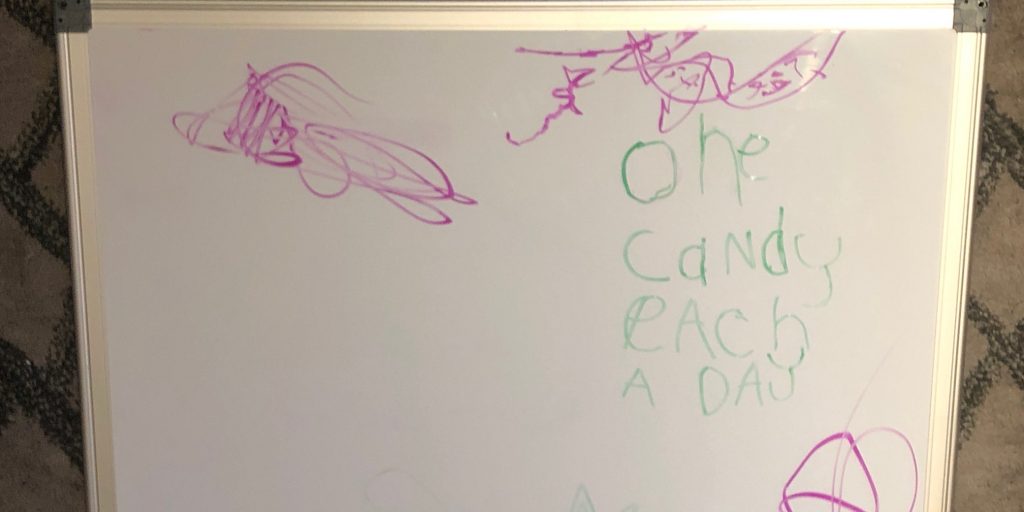

We can’t label shopping broadly as essential. There is a difference between buying milk or fresh vegetables as being essential compared to picking up a package of organic baby arugula. I wrote about access to essential resources in my book, Integrated Investing, in the context of surviving, thriving and be happy. In the midst of a global pandemic, when we talk about essential, first and foremost we’re really talking about essential resources to survive. Many of us are so used to having access to essential resources to survive that we take it for granted and access to essential resources to thrive and be happy start to feel like flotation devices.

Privilege and advantage affect one’s view on essential

As a business owner, if you risk being fined for carrying on non-essential activity and if you are well-capitalized to weather this latest storm, you may very well decide to slow down and pause your business activities. Why take the risk if you don’t have to? However, if you need the revenue, you may deem your business activities and services as essential and carrying on operating. As I write this, I recall reading research on risk-taking behaviour alongside abundance or scarcity of resources. All to say, lack of clear guidance and certainty around whether you are an essential business and the risk of being fined or not, leads to decision-making in uncertainty and risk-taking.